Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Money and maths. These are two subjects that will follow our children for their entire lives. The more we can help them understand the core concepts, how to save, when to spend, and what’s truly worth it, the better prepared they will be for the future. After all, like it or not, our world revolves around money.

There’s an old saying that money can’t buy happiness, and while there’s truth in that, it’s also true that a lack of money can certainly lead to a lot of unhappiness. Money is a tool, and it absolutely helps smooth the path on life’s journey.

As parents, our deepest desire is to do what’s best for our children. It can be tempting to think that shielding them from financial worries is the ultimate gift. However, a growing number of people, from everyday parents like us, to the world’s wealthiest individuals, are realizing that providing skills is far more valuable than providing handouts.

This philosophy is famously championed by billionaires like Bill Gates and Warren Buffett. Both are key figures in “The Giving Pledge,” a commitment by the world’s wealthiest to give the majority of their fortunes to philanthropy rather than their own children. Their reasoning is clear. Leaving children “enormous sums of money” can be more harmful than helpful, potentially stifling their own ambition and potential. As Warren Buffett famously said, he wants to leave his children “enough money so that they would feel they could do anything, but not so much that they could do nothing.”

This underscores a powerful truth. True security comes not from a trust fund, but from the confidence and capability to manage one’s own finances. It’s about teaching them to navigate their own path, learn from their own experiences, and grow into resilient, self-sufficient adults.

While many of us can only dream of leaving our children a vast inheritance, history is full of cautionary tales that highlight why skills are paramount. We often hear about “nepo babies”, children of powerful or wealthy individuals who inherit significant advantages. While some go on to build their own empires, others falter precisely because they lack the foundational financial literacy and discipline that comes from earning and managing money themselves.

Consider figures like Barbara Hutton, the Woolworth heiress. Dubbed “the poor little rich girl,” she inherited an estimated $50 million (equivalent to billions today) in the 1930s but died nearly penniless, having gone through seven marriages and extravagant spending. Or the tragic story of Elvis Presley’s daughter, Lisa Marie Presley, who inherited a fortune of over $100 million but faced severe financial difficulties later in life. These aren’t just isolated incidents, they exemplify a broader pattern.

This phenomenon even has a common saying: “Shirtsleeves to shirtsleeves in three generations.” This proverb, found in various cultures, suggests that wealth rarely lasts beyond three generations. The first generation builds the wealth, often through hard work and frugality. The second generation enjoys it, but sometimes lacks the drive to grow or maintain it. By the third generation, without the same entrepreneurial spirit, financial discipline, or understanding of how the wealth was created, it’s often dissipated. It’s a stark reminder that simply possessing money isn’t enough. The knowledge and skills to manage and grow it are what truly endure.

This idea is further supported by research on early financial education. Studies have shown that core money habits can be formed as early as age seven, and hands-on experience is critical. Simply giving children money without context misses a vital teaching opportunity. The real value lies in guiding them through the process of earning, saving, and spending. If you want to read more about the research backing this, do a quick google search on “teaching kids early about money” and there will be plenty of links available.

So, how do we, as parents, begin to instil these crucial lifelong skills in a way that is both fun and effective?

In our household, our two little apprentices, a six-year-old and a three-year-old, are definitely acquainted with the concept of money. The six-year-old’s maths, however, could do with a bit of work. The three-year-old is a bit young for sums, but because she follows her big brother’s every move, she’s already picking up on the odd bit here and there.

One of my major gripes about teaching money these days is that we live in a largely cashless world. Kids learn visually, and it’s hard for them to grasp the value of money when it’s just an invisible transaction, a tap of a card, or a number on a screen. So, we made a conscious effort to get a stash of real coins and notes from the bank. It turns out physical cash is a fantastic visual tool for learning.

To make it even more fun, we bought some fake toy money. They love to set up their own little “shop,” where they make us buy and sell things, pushing the colourful notes and plastic coins back and forth. More often than not, they get the numbers completely wrong (“That’ll be… seven hundred dollars!”), but hey, it’s a start, right?

The real magic happens when we connect this to the real world. We gave them each a piggy bank, and now we try to use cash at the grocery store. We get them to help pay the cashier and count the change. The first few times we explained that money is used to buy things and that maths helps ensure you pay the right amount, we were met with blank stares, as if we were explaining rocket science. But after a few more tries, you can see the little cogs in their minds start to turn. That “Aha!” moment when they finally get it is priceless.

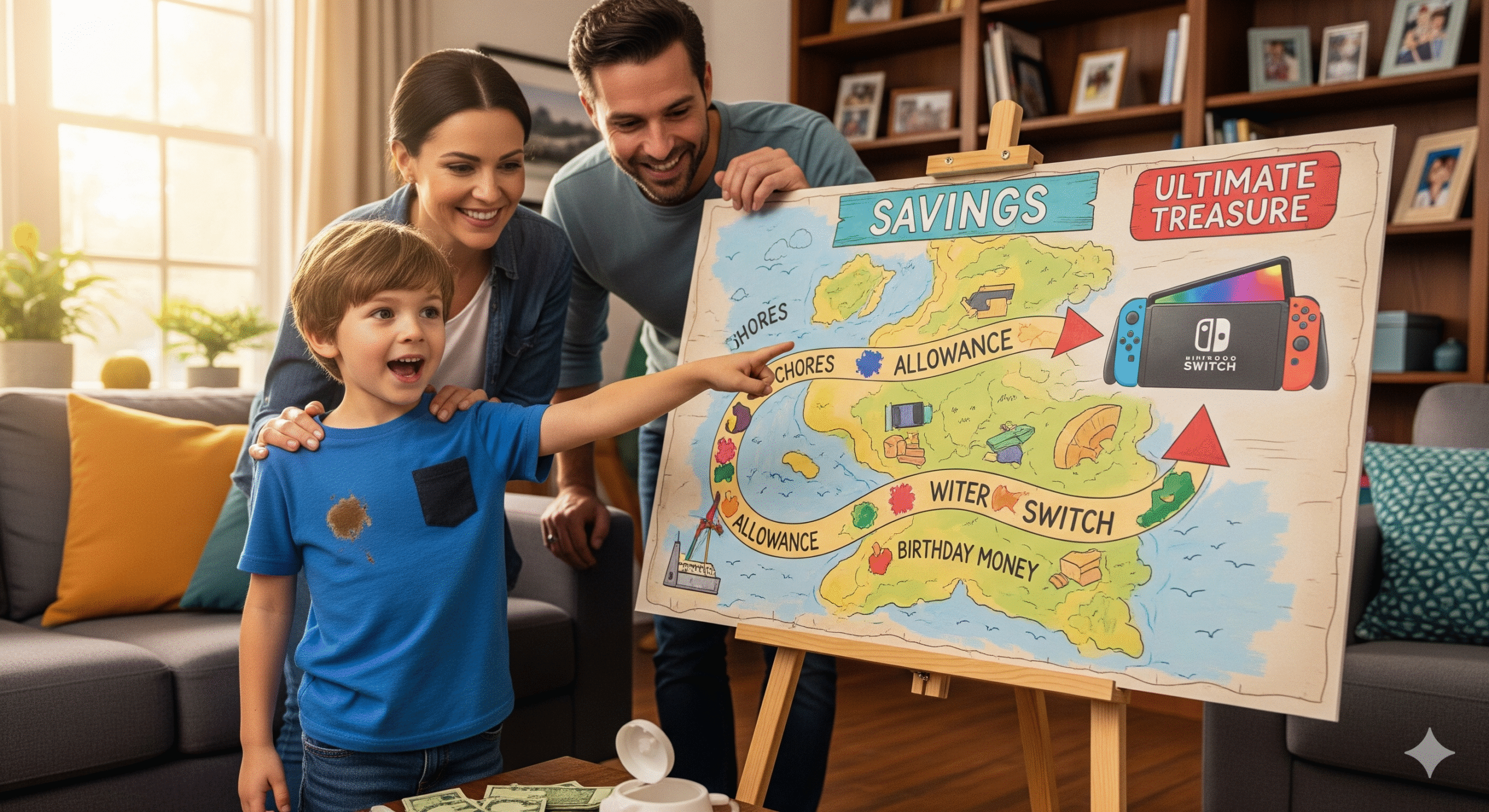

The result? Our six-year-old is now diligently saving for a Nintendo Switch 2.

Now, we have the original Nintendo Switch at home, which they absolutely love. But the Switch 2 only just came out! I was completely surprised he even knew about it. Did the Nintendo marketing machine somehow beam an ad directly into his brain? Did he hear about it in the schoolyard? There’s no hiding them from this stuff, I guess!

He is now a hawk about his pocket money, constantly reminding us that a week has passed and he’s owed his pocket money. We’ve tied this to small chores, like cleaning his room or packing up the play area, so he understands that money has to be earned and isn’t just given out willy-nilly. However, this hasn’t stopped him from shamelessly asking for more money though!

We still have a long way to go. Teaching financial skills is a marathon, not a sprint. But it has been incredibly rewarding to watch them grow in confidence with their money and maths. Although, I’m not exactly looking forward to explaining multiplication and division… that doesn’t sound quite as fun!

So, how do you start this journey? Based on our own chaotic trials and errors, here are a few simple tips that have worked for us. Hopefully, they can give you some ideas to adapt for your own family.

Money can feel like a delicate topic, but there’s no reason to hide it from your kids. They are like little sponges, learning at an incredible pace, and they don’t need to be sheltered from real-world concepts. Start with the basics: “We use money to buy these apples.” That’s it. You’re planting a seed. For us it was actually their inquisitive questions which kicked off the whole money discussion, they saw us tapping away with our card when paying for things and asked why people were giving us stuff. So even without us prompting, the kids are likely seeing the interactions and forming their own thoughts, we just need to help nudge them on the right direction.

You don’t need to sit them down for a formal lesson on economics. Just involve them in everyday moments. Show them a coin when you get a coffee. Let them see you tap your card at the checkout. Their natural curiosity will do the rest. Soon, the questions will start flowing: “What’s this coin for?” “How can we swap it for that apple?” These small, repetitive situations are what build their interest and understanding. It won’t take long, I promise! Practice makes perfect right?

Give them real-world scenarios where they are in charge of the money. Let them pay at the grocery store or give them their own small amount of pocket money to buy something from a lolly shop. These early experiences are invaluable. During a recent road trip, we let our kids use their own money at a lolly shop. The intense concentration on their faces as they weighed up their options was a sight to behold. It was probably the highlight of their day, and I can tell you, they savoured those lollies just that little bit more because they bought them. (The subsequent sugar high was, uh… also an experience.)

If your kids have started school, they’re already learning basic maths. You can make it fun by turning it into a game. We use our set of play coins and get the kids to help us count out change. “If I have ten dollars and I buy this for three dollars, how much is left?” We ran this as a little game, and while their early attempts were hilarious, they once tried to purchase my phone for the royal sum of two $1 coins, their processing speed and accuracy got better with every round. It’s all about practice!

Saving money is much more motivating when there’s a tangible goal at the end of it. For our son, this has changed over time. Initially, it was for Pokémon cards. Then it was Beyblades. More recently, it’s the lofty goal of a Switch 2. The specific item doesn’t matter. What matters is that the underlying concept of saving up for something he really wants has stuck with him. He’s learning that if you want something, you need to earn it and save for it. And that’s the most important lesson of all.

These are just a few of the ideas that have worked in our chaotic household, but we know there are countless other brilliant strategies out there. The real goal is to help other parents on this important journey, and that’s where you come in.

What has worked for your family? Do you have a fun game, a clever trick, or a valuable lesson you’ve used to teach your kids about money? Sharing what has worked, and even what hasn’t, is invaluable for newer parents just starting out.

Please leave your own hints and tips in the comments below. Let’s build a community and learn from each other!