Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

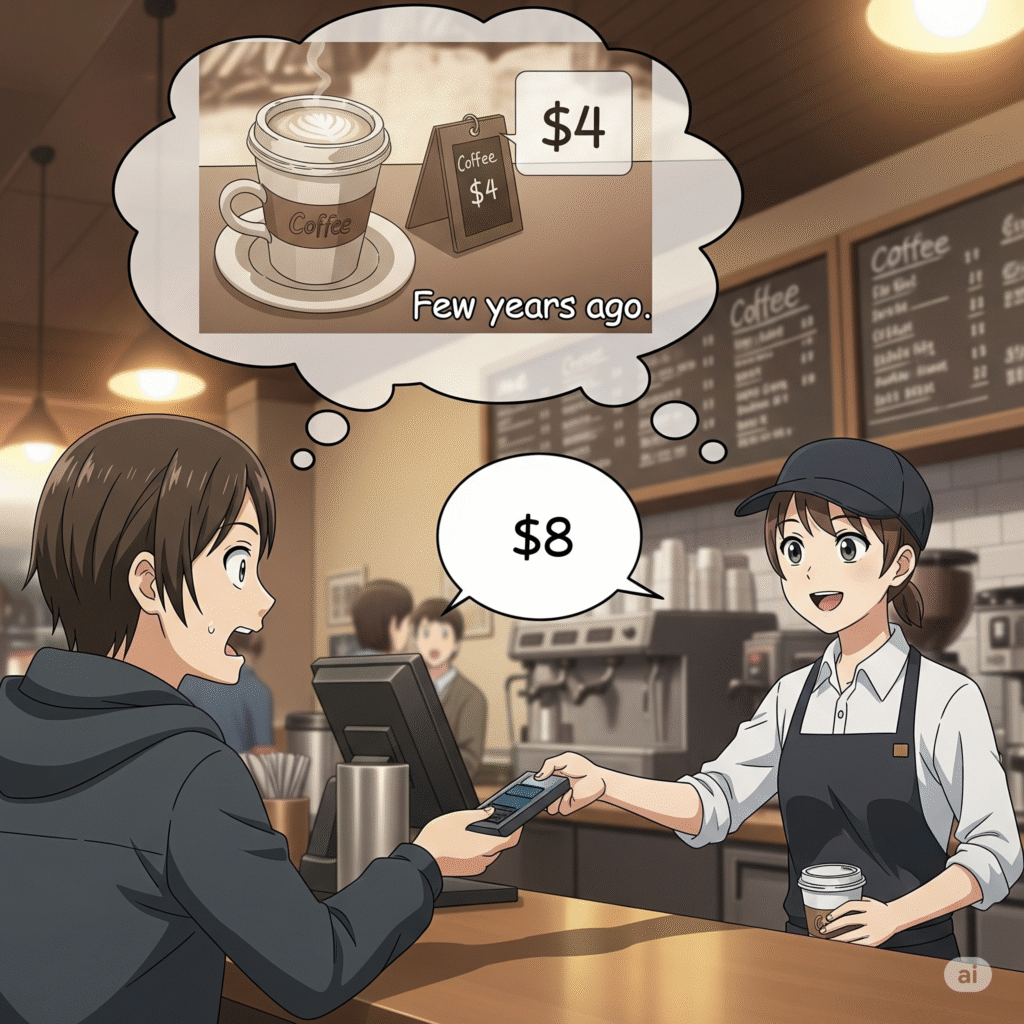

Let’s talk about the cost of living. It’s a topic on everyone’s mind at the moment, and I have a little something I call the “Cup of Coffee Index” to measure it.

I remember when a regular cup of coffee was $3.50, maybe $4. If you were at a fancy, highly Instagram worthy cafe, it might push into the $5 range. Still not cheap, but not expensive enough to be concerned about. Fast forward to today. That same standard coffee is now easily $5 to $6, and that’s not even talking about those fancy cafes. Add a double shot or some soy milk, and you’re suddenly pushing $7 or even $8. It’s absolutely crazy. Not long ago, $8 was almost a full lunch, and now it just covers a single cup of coffee. How times have changed.

Now, indulge me for a moment. If we follow a similar trajectory (and let’s hope we don’t!), by the time our children are adults in 10 or 20 years, a single cup of coffee could cost $15. It’s an unimaginable thought. Who could afford that kind of daily luxury? And I can’t even begin to imagine the price of everything else… It is a scary thought.

This isn’t really about coffee, is it? It’s about the uncertain future our children are growing up in. Seeing costs spiral like this is something that no doubt keeps many of us parents awake at night. I know it does for me, though perhaps I’m just a worry wart.

As parents, we are wired to help our children and put them in the best possible position to succeed. Whether it’s fostering their personal growth or guiding them toward financial self-sufficiency, that desire to help them get ahead burns brightly.

So today, I want to explore some simple, practical ways to help with their finances. Now, don’t get me wrong, this isn’t about setting up some incredible inheritance (though if you can, that’s amazing!). This is about small, achievable habits that can make a huge difference over time.

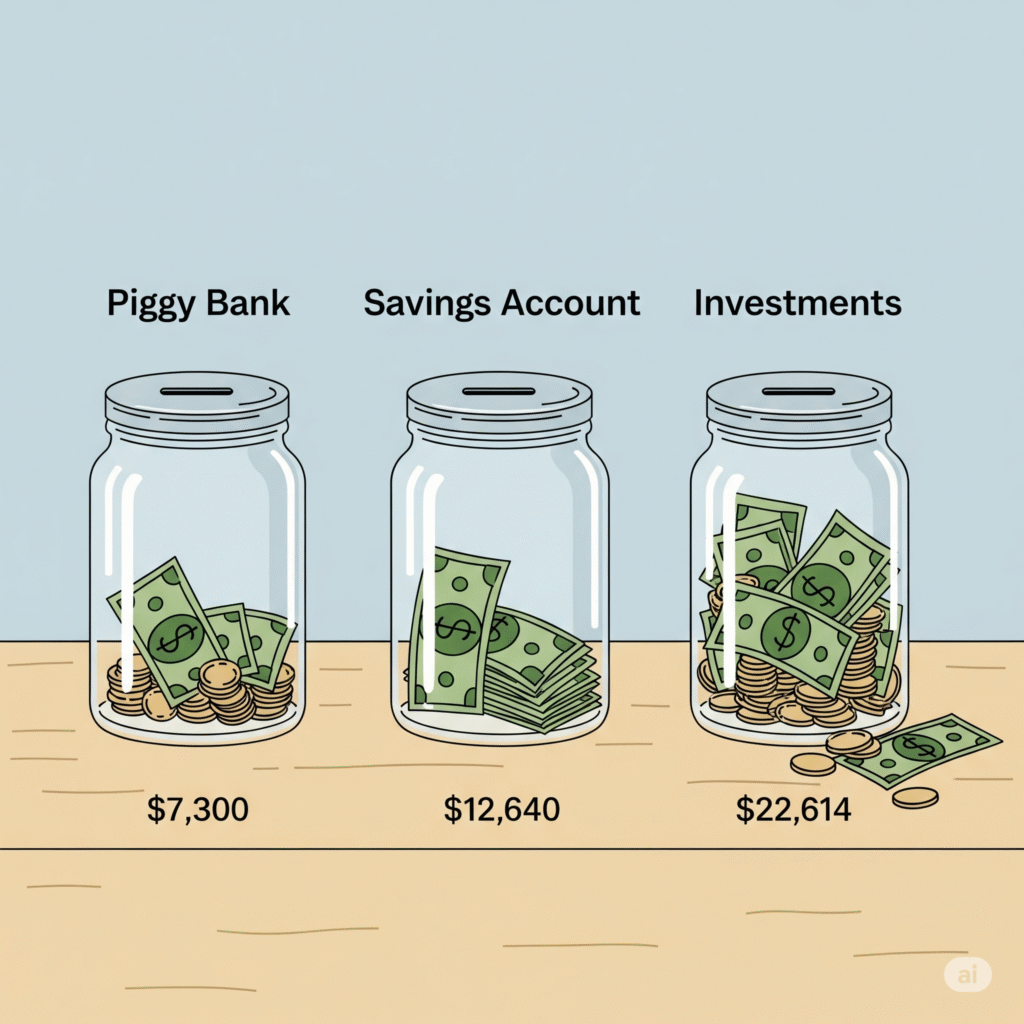

It sounds incredibly simple, but let’s explore what happens if we help our child put aside just a single dollar every day for the next 20 years. We’ll look at three different scenarios to see the impact.

Disclaimer: Savings account interest rates and average returns are all estimates and no doubt will change over time. So don’t be too welded to these numbers, just know that its better than doing nothing at all!

To show you exactly how the magic happens, here’s a table detailing the growth at the end of each year. You can see how the gap between the methods starts small but widens dramatically over time.

| Year | Piggy Bank ($) | HISA at 4.5% ($) | ETF at 9.2% ($) |

| 1 | 365 | 381 | 399 |

| 2 | 730 | 780 | 834 |

| 3 | 1,095 | 1,196 | 1,308 |

| 4 | 1,460 | 1,632 | 1,825 |

| 5 | 1,825 | 2,088 | 2,390 |

| 6 | 2,190 | 2,567 | 3,008 |

| 7 | 2,555 | 3,070 | 3,685 |

| 8 | 2,920 | 3,598 | 4,428 |

| 9 | 3,285 | 4,153 | 5,245 |

| 10 | 3,650 | 4,737 | 6,147 |

| 11 | 4,015 | 5,352 | 7,143 |

| 12 | 4,380 | 6,000 | 8,245 |

| 13 | 4,745 | 6,683 | 9,466 |

| 14 | 5,110 | 7,404 | 10,821 |

| 15 | 5,475 | 8,164 | 12,324 |

| 16 | 5,840 | 8,966 | 13,993 |

| 17 | 6,205 | 9,812 | 15,846 |

| 18 | 6,570 | 10,704 | 17,901 |

| 19 | 6,935 | 11,646 | 20,178 |

| 20 | 7,300 | 12,640 | 22,614 |

Export to Sheets

Note: Calculations are based on adding $365 at the start of each year and compounding annually.

As you can see, even in the worst-case scenario, saving over $7,000 from just $1 a day is impressive. A week’s worth of savings is just the cost of one expensive coffee!

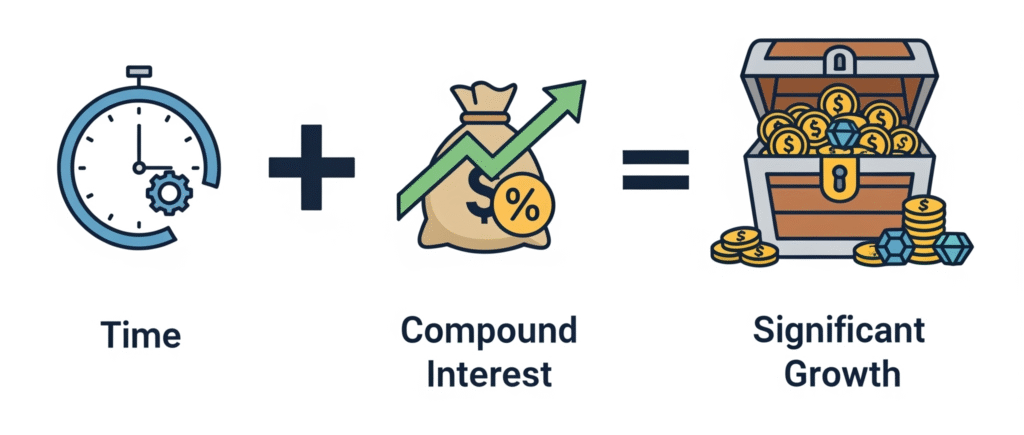

But what’s truly powerful here is the impact of compound interest. It’s the engine that turns a small amount of money into something substantial. And the fuel for that engine is time, something your child has in abundance, especially if you start early. Let’s break down those final numbers:

That is free money earned simply by letting your initial savings work hard over time. The numbers start small, but they grow, and then that growth starts to grow. It’s a snowball effect that can give your child a massive financial edge when they grow up. Imagine if you added an extra dollar or two whenever you could spare it! The number would just get bigger and bigger!

Before you rush off to start, a quick reality check. This information is for educational purposes and is not financial advice. I am by no means a qualified financial adviser, so please do your own research before kicking off this endeavour. Be aware of a few things:

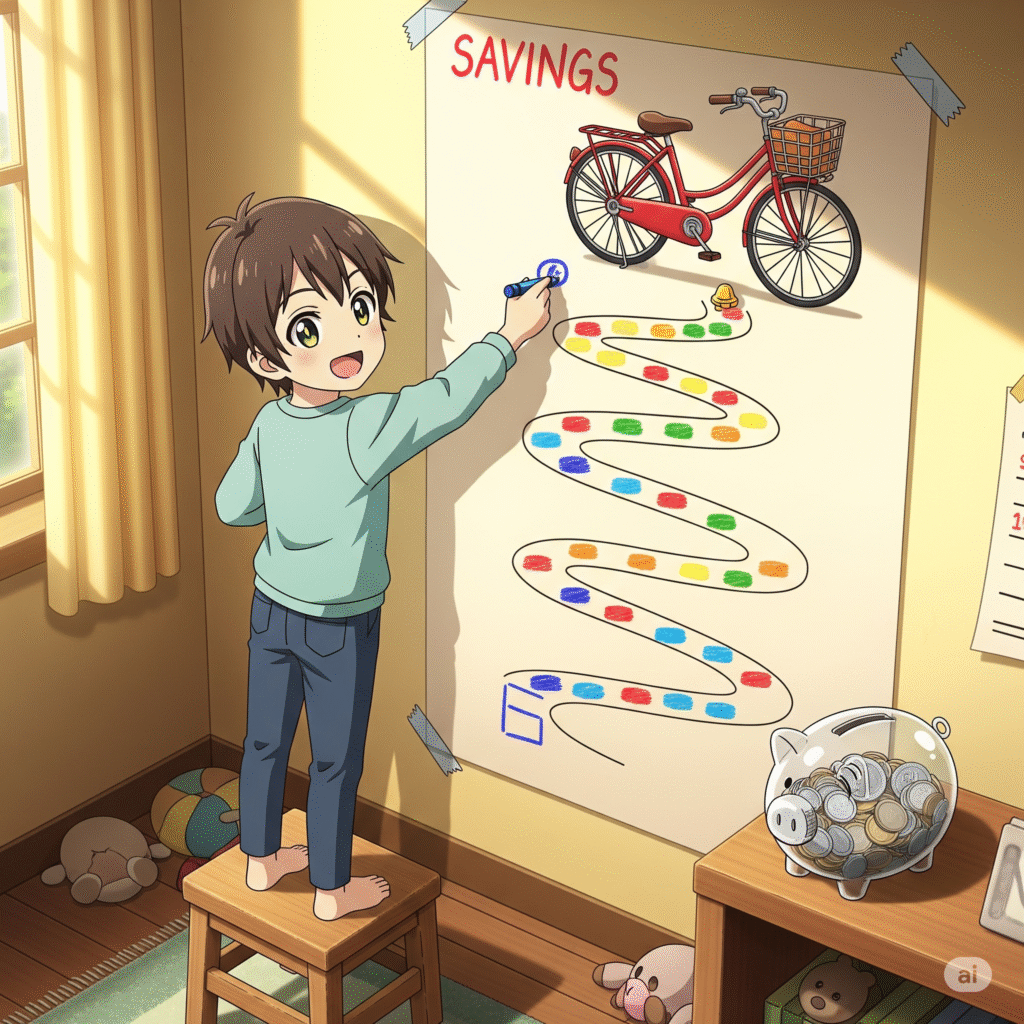

This isn’t just a saving exercise, it’s a teaching opportunity. This might be too complex for a baby, but for a four or five-year-old, it’s perfect. You can walk through the plan with them, watch the numbers grow together, and explain the core concept of saving. If you want to buy something in the future, you save up for it. This is the discipline we want to instil into them from an early age.

The benefit of this lesson is immeasurable. Financial literacy is a critical life skill. Using this simple plan to instil an understanding of how money works is a gift that will last a lifetime, and is probably worth more than the actual dollars you save for them.

We would love to hear from you. What are your thoughts on saving for the next generation? Do you have any great tips or family traditions that have helped your own kids become more financially savvy?

Please share your ideas and experiences by leaving a comment below or getting in contact with us. We’re always interested to learn what works for other families!